Table of Content

Both people and other establishments, similar to mutual funds, can buy TIPS—they're offered in $100 increments, and are only obtainable in electronic type. But in contrast with I Bonds, which do not change arms within the secondary market , you presumably can sell a TIPS bond to another investor through a dealer. You can purchase TIPS directly from the federal government at TreasuryDirect.gov, or you should purchase particular person TIPS bonds by way of your brokerage firm. TIPS could be a good investment selection when inflation is working high, since they regulate funds when rates of interest rise, whereas other bonds do not.

James Chen, CMT is an professional dealer, investment adviser, and global market strategist. The breakeven reflects a level of expected inflation that, if recorded, would produce the same adjusted money flows between proudly owning a nominal Treasury and TIPS bond. If actual inflation is greater than anticipated, the adjusted money flows from owning TIPS will exceed these from a nominal Treasury, and vice versa. A target-date fund is a fund provided by an investment firm that seeks to develop belongings over a specified period of time for a focused objective. Investors are taxed on each the annual revenue and the quantity of the adjusted value. The Vanguard Inflation-Protected Securities Fund is certainly one of the largest TIPS funds out there with $41.2 billion in web property.

Can The Entire Return On Suggestions Be Negative?

This TIPS function helps preserve the purchasing power of your funding. The worth of odd bonds, which typically feature fastened par values, may be eroded over time by gains in inflation. To summarize, TIPS could be a wonderful tool for any investor looking to maximize a portfolio's risk-reward payoff. Just as fixed revenue is an integral facet of any portfolio, TIPS ought to be thought of an integral facet of the fixed-income allocation. However, if the goal is to obtain a totally diversified fixed-income portfolio of TIPS, a mutual fund is the best suited choice, ideally a low-cost index fund. Ideally, you’ll want your portfolio to be made up of a few completely different asset lessons.

Before investing, contemplate the funds' investment aims, dangers, charges, and bills. Contact Fidelity for a prospectus or, if obtainable, a abstract prospectus containing this information. You would possibly be succesful of avoid federal taxes on some or the entire interest earnings on your I bonds should you use the proceeds to pay for qualified faculty expenses for yourself, a spouse or dependent. To qualify, you have to have been a minimal of age 24 when the bonds were issued, and your income must fall inside sure limits.

How To Choose On The Proper Asset Kind In Your Portfolio

The coupon rate stays fixed, thus generating various amounts of interest-based off on the inflation-adjusted principal. The end result's that investors are protected towards inflation. If you keep these factors in thoughts, TIPS investing will be simple and highly helpful to your portfolio. TIPS is probably not probably the most thrilling investment round, but they're the one securities that present a guaranteed actual rate of return by the united states federal authorities.

An investment in the Fund isn't insured or assured by the Federal Deposit Insurance Corporation or another authorities company and its return and yield will fluctuate with market situations. Carefully contemplate the Funds' investment aims, threat factors, and expenses and expenses before investing. This and different info may be discovered in the Funds' prospectuses or, if out there, the summary prospectuses, which can be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages.

What Are Stocks And The Way Do They Work?

For a given ETF value, this calculator will estimate the corresponding ACF Yield and unfold to the related government reference security yield. Note that the ACF Yield will differ from the ETF's Weighted Avg YTM.For more information on Aggregate Cash Flow Yield, see information here. TIPS are designed to guard investors from the adverse results of rising costs over the life of the bond. The par value—principal—increases with inflation and reduces with deflation, as measured by the CPI. When TIPS mature, bondholders are paid the inflation-adjusted principal or unique principal, whichever is larger.

All data is from MSCI ESG Fund Ratings as of Sep 21, 2022, primarily based on holdings as of Aug 31, 2022. As such, the fund’s sustainable characteristics might differ from MSCI ESG Fund Ratings from time to time. This fund does not search to observe a sustainable, impression or ESG investment technique.

As a end result, buyers have begun to maneuver into TIPS at an growing pace. The principal quantity is protected since buyers will never obtain lower than the originally invested principal. Gordon Scott has been an energetic investor and technical analyst of securities, futures, foreign exchange, and penny shares for 20+ years. He is a member of the Investopedia Financial Review Board and the co-author of Investing to Win.

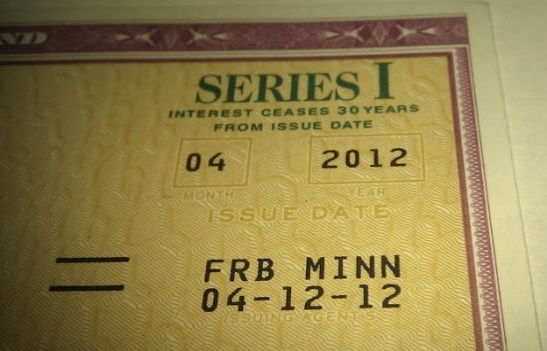

These authorities bonds pay extra curiosity when inflation rises however differ in key methods. I bonds continue to earn interest for 30 years, though you don’t have to hold the bonds that long. However, if you redeem bonds throughout the first 5 years, you’ll forfeit the last three months’ worth of interest. Index performance returns don't reflect any management charges, transaction prices or expenses. Indexes are unmanaged and one can not make investments directly in an index.

Some have called TIPS the only risk-free investment because of their principal security and inflation protection options. However, one of the major indicators of risk is value volatility, and TIPS often come up missing in this department. This example is for illustrative functions solely and does not represent the efficiency of any safety. Consider your present and anticipated funding horizon when investing choice, as the illustration could not replicate this. The assumed rate of return used on this instance just isn't assured. I bonds are savings bonds offered by the US Treasury whose charges change relying on inflation.

(The higher limit on TIPS purchases runs into the millions.) That makes them the only reasonable choice for bigger buyers looking to construct a large stake in inflation-fighting investments. TIPs shouldn't be viewed as a “be all” different to broad bond diversification, and traders ought to use different forms of bond fundsas well. Although they're indexed to inflation, they aren't assured to extend in worth during inflationary intervals. TIPS reply more to expectations of investors, versus actual actions of inflation. And now, on Thursday, the Treasury will offer $15 billion in a reopening public sale of CUSIP 91282CEZ0, creating a 9-year, 8-month TIPS. At this point, although real yields are down, this TIPS nonetheless looks engaging.

No comments:

Post a Comment